Born from Silicon Valley innovation and built to serve a diverse membership, KeyPoint Credit Union is a full-service, not-for-profit financial institution dedicated to providing banking solutions to help members achieve their financial goals.

Around the world, credit unions stand as beacons of community-centered, people-first financial alternatives, and Keypoint is no different. They take pride in their mission to redefine member experiences, providing convenience and genuine value in a landscape dominated by impersonal for-profit banking systems.

29%increase

in Day 30 app retention

248%uplift

in the fast balance usage app feature

20%growth

in monthly active users within a year of deploying these campaigns

34%boost

in payment feature usage within the app

The Challenge

Bridging the gap in a digital landscape

KeyPoint faced the challenge of staying true to its community-oriented roots while meeting the growing expectations of members for real-time customer support and a seamless online banking experience.

KeyPoint needed a dynamic and scalable customer engagement solution to bridge this gap without sacrificing its core values. Their goal was to educate members on the features and capabilities of their online banking app in a way that was personal to each member and integrated into their individual banking routine. They needed to be able to create a continuous, engaging dialogue with their members, ensuring every interaction was relevant and instrumental in maximizing retention.

“Exceptional member experiences are core to the KeyPoint service mission. We pride ourselves on using advanced technology to offer value to members in their moments of need.” — Andy Ramos, EVP/CRO

The Solution

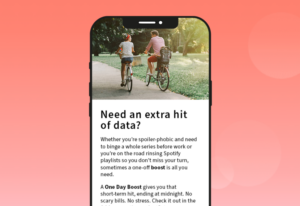

Targeted push and in-app notifications for new banking members

KeyPoint used MessageGears to send targeted push and in-app notifications to new members. Every message was tailored, prompting members to explore relevant features of the app—from signing up for text alerts to viewing statements and exploring offers.

The goal was to educate new members about the app’s features, fostering a deeper understanding that would translate into faster, more convenient experiences. KeyPoint smartly directed its message targeting only to users who hadn’t yet discovered the promoted features, ensuring a relevant and personaliized outreach.

Geo-triggered campaigns

Adding another layer to their strategy, KeyPoint launched geo-triggered campaigns. Using location data, they deployed messages highlighted their premier market accounts as members approached within 100 meters of a nearby branch.

“Having the ability to target members based on what they have or haven’t done in real time has been really valuable for us. Controlled experiments have shown measurable increases in app engagement, feature usage, and app retention.” — David Greene, Marketing Manager at KeyPoint

The Outcome

In partnership with MessageGears, KeyPoint Credit Union achieved:

Growth in monthly active users: the engagement strategy translated into a 20% surge in the number of members actively using the app each month. This growth signals a sustained interest and involvement within the KeyPoint community.

Increase in Day 30 app retention: KeyPoint tackled the challenge of member retention head-on, achieving a 29% increase in Day 30 app retention. This was achieved by delivering relevant 1:1 experiences and demonstrating the value of the app to new users.

Surge in Fast Balance usage: promoting the Fast Balance feature resulted in an astounding 248% spike in usage, showing a shift in how members accessed and interacted with their online banking.

Increase in Payment usage: KeyPoint’s focus on enhancing user convenience paid off with a 34% increase in the Payment feature usage, helping members make payments faster and more conveniently.

Uplift in Money Transfer usage: by showcasing the ease of use of the Money Transfer feature, KeyPoint saw a 17% increase in usage, helping members save time and avoid physical visits to branches.

~ Belinda Blair, Vice President of Marketing

Driving high-value interactions at scale

In an ongoing collaboration, MessageGears proudly stands as KeyPoint Credit Union’s trusted partner, continually delivering push and in-app messages that improve onboarding, engagement, and customer satisfaction.

Read more of our client success stories.